Small Business Tax Services

HOU.TAX is a boutique CPA firm specializing in tax and consulting services. How can we help you and your small business succeed?

Our services include:

Tax Preparation and Compliance

Preparation of federal and state tax returns:

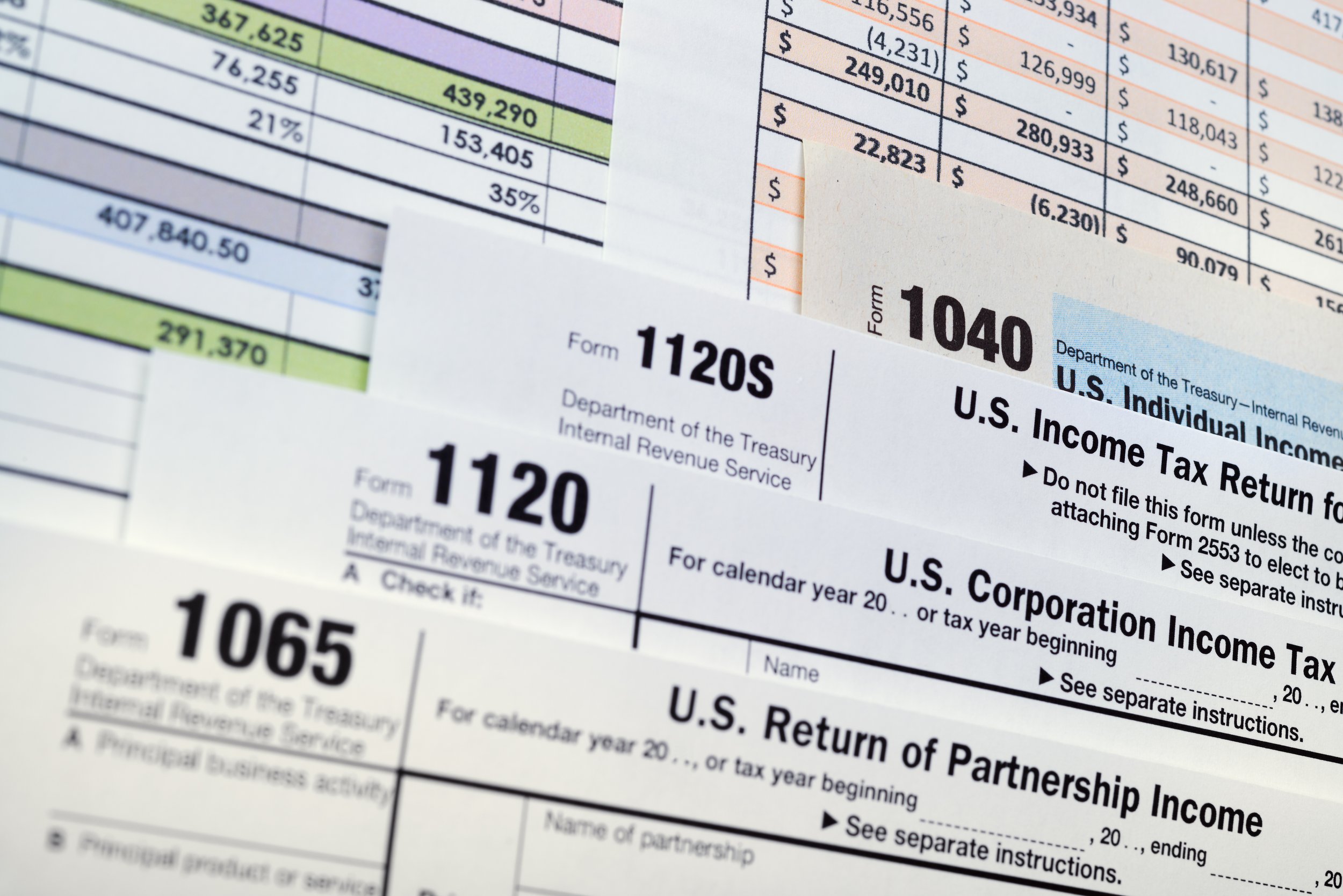

Single member LLCs and sole proprietorships: Schedule C

Partnerships: Form 1065

S Corps: Form 1120S

C Corps: Form 1120

And all related State income tax filings

Compliance with federal and state tax laws and regulations

Filing of quarterly estimated taxes for both Federal and State taxes

Tax Entity Selection:

We provide advice on choosing the appropriate business structure

We provide a cost-benefit analysis of changing your tax entity to an S Corp.

At HOU.TAX, we understand the unique challenges faced by small businesses and are dedicated to providing the highest quality tax and consulting services. Whether you are starting a new business, or looking to optimize your tax position, our experienced CPAs are here to help. Contact us today to schedule a consultation and discover how HOU.TAX can support your business success.

THREE STEP PROCESS:

Schedule a Consultation: Arrange a quick, ten-minute telephone consultation with Mark or Trey. They’ll assess your tax situation and answer a few of your questions. And tell you what they need to give you a quote.

Submit Documents: Provide your documents for review. Submit via secure email or through our portal.

Receive a Flat Fee Quote: In most cases we’ll give you a flat-fee quote or tell you why we can’t. No surprises, no hourly rates, no software fees, no nonsense.